Geoff Di Felice & Marcus Guzzardi

Real Assets provide ballast to the portfolio as low correlation investments which maintain their real value over the long term. At certain points they may be a potential source of capital for re-deployment into Compounding or Reversionary opportunities.

We strictly avoid highly financialised investments such as those with excessive leverage or high institutional ownership which can dilute the “real” attributes of the underlying asset e.g. many listed property or infrastructure assets. Instead, we have gravitated towards Royalties and in particular Mineral Royalties.

In last year’s letter we provided an overview of Royalties, which make up approximately 12% of the Fund. This year we will add to this by providing an overview of a key value latency we focus on – Long-Life Value Latency.

Royalty investing is a specialist asset class; this is due to the heterogenous nature of both the underlying assets and the structures. A royalty asset could be a 10-year royalty over an asset at the high end of the cost curve, or it could be a perpetual royalty over the most cost advantaged mines.

It is the latter that we focus on, as we believe very long-life assets have significant value latency that is fundamentally misvalued by capital markets. This is because standard valuation techniques fail to capture their magic, and most investors have time horizons measured in months and quarters, not decades.

Long-Life Value Latency

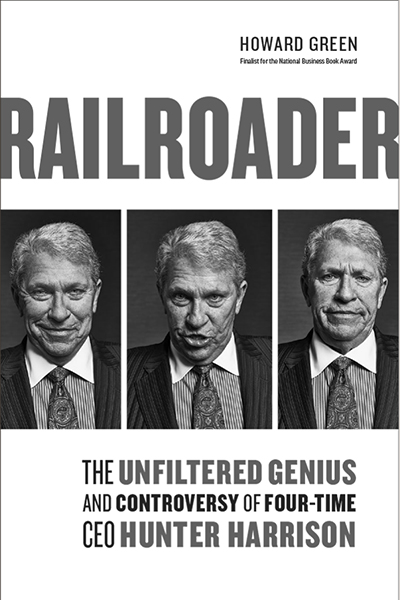

Let’s assume we have two cash flow streams, Asset 1 (20-Year Asset) and Asset 2 (100-Year Asset). Both will pay you $100 per annum; Asset 1 will pay this every year for 20 years, and Asset 2 for 100 years.

Assuming you discount these cash flows at 8% (to compensate you for risk and inflation) you would only pay a ~30% premium for Asset 2 despite it having an asset life five times longer! This is due to those far-out cash flows (years 21 to 100) receiving low value¹.

However, these long-life assets have two powerful sources of latency:

- Low Depreciation ; and

- The potential to be “brought forward”

Whilst the value premium the 100-year asset receives initially is just 30%, this increases every year as the 20-year asset approaches $0 value in year 20, at which point the 100-year asset has lost less than 1% of its value, with 80 years of cash flow remaining.

Source: Internal Cooper Investors Analysis

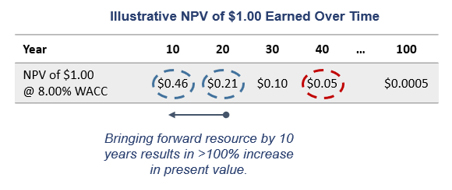

Just as the value of a cash flow occurring many decades in the future has little value today, there is extraordinary value in bringing those cash flows forward, as shown in the table below. This occurs when more capital is invested to expand a mine or new technology emerges that improves extraction rates.

Source: Internal Cooper Investors Analysis

Let’s bring this to life with some case studies.

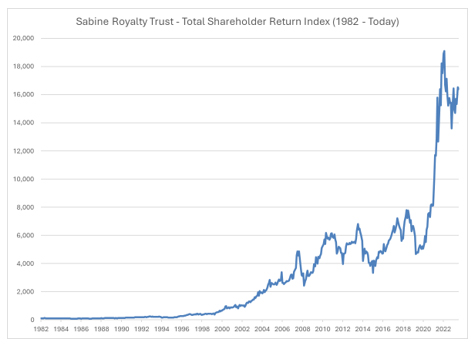

Sabine Royalty Trust Case Study

“In 1982, when the Trust was first formed, it was estimated that the reserves for the Trust were approximately 9 million barrels of oil and 62 billion cubic feet of gas. At that time, the Trust was expected to have a life span of 9 to 10 years and be fully depleted by 1993. In the 40 years since the inception, the Trust has produced approximately 23.1 million barrels of oil and 288 billion cubic feet of gas.

As a result of this production, the Trust has paid out approximately $1.466 billion to Unit holders over the years”

– Sabine Royalty Trust, Annual Report 2021

The Sabine Royalty Trust (SBR) illustrates a case of a very long-life asset which was underappreciated. At the time of founding, the Sabine Royalty Trust was assumed to have just 9-10 years of resources remaining. This was based on existing technologies and drilling methods. But as a perpetual claimant on this resource, all future technology developments accrued to them (at no cost as a top-line royalty owner). This has resulted in decades of royalty payments creating extraordinary value for investors.

Source: Factset

PrairieSky Royalty Ltd.

We are investors in PrairieSky Royalty Ltd. (PSK) a perpetual royalty owner over significant lands in Canada’s Western Canadian Sedimentary Basin (WSCB), providing our investors with the Long-Life Value Latency described above.

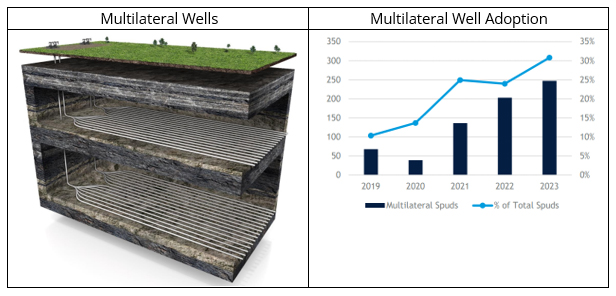

One of the key recent technology developments in the WSCB (a heavy oil basin) has been the adoption of multilateral wells. Multilateral wells are significantly more efficient as they create multiple laterals per wellhead. This reduces the number of wells required (reducing drilling costs) and improves recovery volumes (enhancing the economics of reserves). In some cases, this can lead to operators doubling their recovery rates. The adoption rate is increasing across PSK land (now around 30%) as operators learn and apply it more broadly. The improved economics drillers achieve will increase their investments and ultimately bring forward our economics.

Source: PrairieSky Royalty Ltd.

For Long Life related latencies to be realised the company must own resources with low disruption risk (i.e. will they be needed in 25 years time?), a high quality resource (to attract industry investment) and the focused management behaviour to realise and protect value.

To give a sense of latency, we estimate this company will earn circa 60% of its market value over the next decade in free cash flow. There is then a further four decades of reserves beyond this. As a top line royalty owner, this all comes without having to spend another cent.

¹ Using a Discounted Cash Flow technique cashflows are discounted using the following formula, Discount factor=(1/((1+8%)))n, where n = year. So, $100 in years 25/50/100 is worth just $14.60/$2.13/$0.05.