Geoff Di Felice & Marcus Guzzardi

“It was like he had trained all his life for that position. It was like he’d been genetically designed for that particular period of time.”

Warren Buffett

Describing John Byrne (Geico CEO 1975-1985)

On The Road Lunch with Pat Ryan

When we saw the twinkle in Pat Ryan’s eyes as we shook his hand it confirmed how integral our visitation program is to our investment approach. We were in Naples, Florida on our maiden trip as part of the Endeavour Fund, sitting down to lunch with insurance legend and Ryan Speciality Group (RSG) Founder Pat Ryan and his President Tim Turner at Pat’s Country Club.

The ambition of this trip was to nurture the relationships with the founders and executives of our key holdings as well as build some new relationships. We traversed the US meeting incredible entrepreneurs, many who generously spent several hours with us discussing their careers, businesses and the emergent opportunities and risks they are observing.

The Endeavour Fund is relationship-centric not transactional, this means we invest the time and energy to build partner-like relationships with a small group of exceptional leaders. It has taken us over a decade to build our reputation as thoughtful, long term investors and cultivate this global network.

Lunch with Pat and Tim in many ways represents the pinnacle of this effort. We are excited to share the insights from this experience with our investors. But there’s a trap in investing in falling in love with yesterday’s champion or viewing managements’ actions with rose tinted glasses (we have committed both these sins many times).

So we have developed a simple saying: we don’t write Corporate Biographies. By this we mean, we’re not looking to write about past victories, we want to participate in the future success. We look for leaders with a track record of success AND with their best years ahead of them.

To apply the blow torch to the concept, the above Warren Buffett quote is what we ultimately aspire to see in our investments – they are genetically designed for the opportunities in front of them.

Royal Poinciana Country Club, Naples.

Though we had not met Pat before he was very familiar to us as the CI Global Equities Fund is a long-term shareholder of another firm he founded, Aon Corporation. Pat is a one of the great American success stories.

Pat was born and raised in Milwaukee where his father owned a Ford dealership. When Pat graduated from University one of his early pursuits as a young insurance agent was to offer insurance directly to auto dealership customers. At 26 he formed his own firm focusing on this endeavour and within seven years Pat had taken the company public.

Pat was observing that risks were becoming larger and more complex (driven by things like climate change, cyber security and novel health risks). So shortly after retiring from Aon, Pat decided to form RSG, a wholesale insurance broker with specialty expertise. RSG sits between a retail broker (like Aon) and the insurance carrier to facilitate the coverage of hard to insure risks that cannot be covered by standard insurance contracts.

Tim Turner is President of RSG having been with Pat since its inception. He started his career as a SWAT Officer (so we were a little nervous shaking his hand!). But Tim is a warm person who exudes energy and passion – particularly for talent and team development. Through a mutual friend Tim and Pat met over a beer in 2010 where Pat laid out his plans for RSG. At the time Tim was the CEO/ President of another wholesale broker, CRC. But following that conversation he decided to join Pat and the partnership was forged.

Today RSG is generating close to US$2B in revenues as the second largest wholesale broker in the United States and Tim’s stake in the company is worth $500m. He describes his first meeting with Pat as the “luckiest beer I ever drank”.

Niche Services Companies

“Niches get Riches” is commonly used to describe the attractive economics of niche industrial companies. These companies provide mission critical products that constitute a small component of their customer’s costs, making these customers quality, not price focused and very loyal.

We have observed a similar phenomenon in niche services companies. These businesses provide highly specialised, mission critical services that are beyond the core competency of the customer and often have the opportunity to roll up a fragmented industry. We have observed that proprietorial management teams are central to the success of niche services winners.

Insurance Brokerage is a great opportunity for a niche services dominator, like RSG. This is due to:

- Stable Demand

With high recurring revenue – business insurance is unavoidable - Need for specialised advice

Business insurance is complex and tailored - Favourable economics

Highly cash flow generative and capital light (brokers don’t take underwriting risk on balance sheet) - Fragmented Industry

With scale economics emerging for the dominant player – insurance is becoming ever more complex, this means only large brokers able to provide specialised advice.

RSG entered the public markets in July 2021 amidst a record year for IPOs (with over 2,000 in the US alone). With such an exuberant backdrop we were not identifying much value latency in this part of the market – but the exception was RSG. We were deeply familiar with the people and the industry and could derisk the investment. We could see how Pat and his team executing against their strategy would create a pathway for us to meet our return objectives.

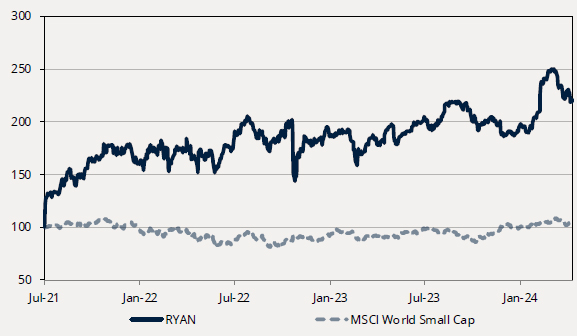

The below graph shows the performance of our investment in RSG relative to the Small Company Index across our investment period. So far, so good. We continue to hold Ryan as a core position in the Fund as a Compounder.

Performance: CI Endeavour Ryan Speciality Group (RSG)¹

Business Lessons

Our conversation with Pat and Tim became a masterclass in creating a high-performance niche services company. Three themes emerged during this conversation and these will form the core of what we will look for when we assess other potential niche services opportunities.

- Independence

The key is to create a customer-centric culture and always be seeking to create more value. Being part of a broader group can force competing priorities but independent firms can focus solely on optimising for the customer; - Talent

These are talent businesses. RSG has developed a talent development machine which is both highly intentional but also highly flexible. The flexibility point is crucial – it gives the freedom for talent to find their path, which includes moving talented people into another team when they’re not thriving. - Specialisation

RSG uses its scale to create specialist verticals (like cyber insurance). This allows RSG to add more value than generalist competitors, and ultimately deepen their relationships and maintain their fee structures.

We look forward to sharing insights like this one with our investors and hope to also organise events where you can speak directly with people like Pat and Tim.

¹ Past performance is not a reliable indicator of future performance.